Commercial Equipment Leasing

$3,000 to $10,000,000

Application Only up to $150,000 for qualified businesses- No Financials

All Industries. All Business Sizes. All Credit Levels.

We can service a wide range of requests because we strategically structured three distinct methods to finance equipment based on your business’ strengths.

We will focus on either Credit, or Cash Flow, or Collateral Values. Whichever program is better for your business. You don’t need to choose. Our certified business finance consultants will help you navigate to your optimal solution.

Credit Based Equipment Finance – The most familiar method for most people, qualifies a business based on credit history and previous finance history.

Equipment up to $150,000 will typically need just an application, invoice for the equipment and the last three months business bank statements, but we can often waive the bank statements if necessary.

$150,000 to $10MM applications will require a full financials submission including 2 years Income statements, Balance Sheets, Tax Returns, and Interim Financials.

Cash Flow Based Equipment Leasing – If there are credit challenges to overcome, we structure funding on the business cash flow, taking the focus off credit.

Equipment up to $100,000 requires an application, an invoice for the equipment, and the last three months business bank statements.

Above $100,000, we require a full financials submission including 2 years Income statements, Balance Sheets, Tax Returns and Interim Financials.

Collateral Based Equipment Finance – For qualified heavy equipment, if we can get to a strong loan to value, we can fund regardless of credit score and time in business. This program will fund from $10,000 minimum, up to $400,000.

You can do this by either making a down payment of 25%-50% of the cost of the equipment or using additional collateral to secure with a lien (owned equipment with equal or greater value).

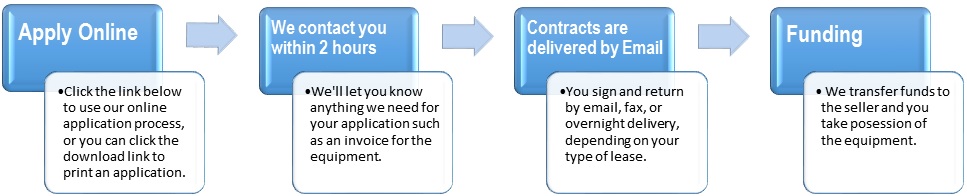

We make applying for equipment leasing easy!

CLICK HERE to Apply Online For Fastest Processing 24/7

or CLICK HERE TO DOWNLOAD A PDF APPLICATION that you can complete and email or fax over.

or Call (877) 703-3090 for additional information.

A certified business finance specialist will contact you within 2 business hours Mon-Fri, 8AM -6PM.

The vast majority of businesses in the United States lease equipment at some time or another. At Coastal Capital we have lease programs to fit every need. Our clients enjoy the most comprehensive range of services and competitive terms offered. In any Commercial Equipment Lease there are many options available to tailor it to your needs. We will clearly explain and review your options with you and help you decide which is best for you. The most common options include:

- $1.00 Out Leases

- 10% or 20% Residual Leases

- FMV Leases

- Multiple Payment and Down Payment Options

- 24-84 Month Terms

Call to speak with one of our Certified Business financial ![]() Consultants to determine which option works best for your needs.

Consultants to determine which option works best for your needs.

(877) 703-3090

Operators are standing by 24/7

Specialty Lease Programs

Sale & Lease Back

Leaseback is a useful tool for companies needing working capital who do not want to use their bank lines, or have credit issues. With the Leaseback program, we can use the equity in your existing equipment to give your company the working capital it needs. We buy your equipment and lease it back to you. When all the payments are made, you own the equipment again. CLICK HERE to learn more.

Startup Program

A business less than two years old is generally considered a Startup. Most banks have severe limitations on extending credit to a Startup. Ironically it’s the time businesses are most in need. A new business needs the ability to build on opportunities and we can provide the capital to enable them to grow with our Startup Equipment Lease Program.

B, C and D Credit

The economic conditions of the last few years have caused many businesses financial suffering and many times that stress has spilled over into the owners’ personal credit profiles. More and more businesses fall into “B” credit category. Experts don’t expect this to change very soon. Even after the economy recovers, it takes time for the balance sheets and credit bureausto reflect stability. The picture isn’t any better for C and D credit tiers. There are good reasons we are more effective than other finance companies with B, C and D Credit:

-

-

- Coastal Capital has always been an expert in non-standard finance programs.

- 20 years of non-standard loan originations, underwriting, back office, due diligence, loan structuring and collection.

- Strategic partnerships with founders across America servicing a full spectrum of credit ratings and niche markets.

- Access to non-standard capital resources capable of structuring “outside the box” solutions.

- Alternatives to traditional Credit Based Leases including, Collateral Based Leasing and Cash Flow based Leasing. With some of our programs, credit scores have absolutely no bearing on underwriting. Our market position enables us to analyze business needs and structure finance offerings that are as appealing to funding institutions as they are to our clients. We can provide finance for the distressed business and can give problem credit clients a “second chance” to capitalize their businesses and rebuild their credit.

-

TRAC Leases

TRAC Leases

An acronym for Terminal Rental Adjustment Clause, this is specifically designed for over-the-road vehicles and trailers. A TRAC lease guarantees your business a pre-set buy out price for the vehicle when the lease expires. This type of equipment lease is a great tool for business owners who want the option of buying the vehicle for a pre-determined price at the end of the lease and typically offers lower payments than a standard lease while providing certain tax advantages.

Government and Municipal Leasing

We can provide lease financing to any government or municipal entity with guaranteed approval. The rate is determined by the rating of the municipality or government agency. We can finance any entity controlled federally, by any state or by any local municipality including Armed services, Public Schools, Libraries, Police and Fire Departments and more. Please contact us so one of our finance specialists can discuss your specific needs and how we can arrange the equipment financing your company requires.

Why Lease?

Leasing is the right choice!

80% of U.S. businesses, from Fortune 500 to the local family business, lease some portion of their equipment. By leasing your equipment, there is less impact on your cash flow, lower fixed monthly payments, preserves existing business credit lines, helps eliminate equipment obsolescence and has significant tax advantages. We can structure a lease for virtually any type of commercial equipment, including software and installation costs. A Business Equipment Lease from Coastal Capital Group Inc is the right choice.

Low monthly payments

The monthly lease payment will usually be lower than the payment required by other methods of financing.

Preserve your cash flow

Businesses need to preserve their capital to fund growth, expansion, and operations. Growing businesses need cash to expand and purchase new equipment. Established businesses need cash for operating capital, expansion opportunities, and replacement of old and obsolete equipment. With new equipment leasing, your upfront costs are minimal. You get the equipment you need and comfortably spread your payments out over time.

Businesses need to preserve their capital to fund growth, expansion, and operations. Growing businesses need cash to expand and purchase new equipment. Established businesses need cash for operating capital, expansion opportunities, and replacement of old and obsolete equipment. With new equipment leasing, your upfront costs are minimal. You get the equipment you need and comfortably spread your payments out over time.

Preserve existing lines of credit

Business or Commercial Equipment Leasing has no impact on your bank credit lines. Protect your borrowing power for short-term capital needs for operations and opportunities.

Eliminate obsolescence

Technology is always advancing. Equipment you purchase today may be obsolete three years from now. New equipment leasing allows you the flexibility to maintain a competitive edge by giving you today’s best technology and allowing you to upgrade when the equipment has outlived its advantage.

Fixed payments through the term of the lease

Unlike bank lines of credit that usually have variable rates, lease payments are fixed. In the 1980’s rates rose from 9% to over 20% in one year causing severe hardship for many businesses. In 2008 and 2009 the financial markets were in turmoil and are still not completely stable. By choosing to lease, you protect yourself from market fluctuations outside of your control.

Significant tax and accounting advantages

Prudent businesses take advantage of the tax deductions for equipment as set out in section 179 of the US tax code. Lease payments are generally reported as line item expenses on your P&L statement instead of being depreciated over long terms. And since lease payments can usually be treated as a pre-tax business expense you can reduce your taxes. Paying cash for equipment automatically adds 30-40% to the cost when you realize that cash = profits and taxes are paid on profits.

Coastal Capital is a member of the National Association of Equipment Lease Brokers and adheres strictly to their code of ethics.

Equipment Lease Brokers and adheres strictly to their code of ethics.